CARES ACT: Will SBA Affiliation Rules Cause Startups and Portfolio Companies to be Ineligible for PPP and EIDL Loans, and is Relief on the Way?

Under the Coronavirus Aid, Relief, and the Economic Security Act (CARES Act), two loan programs are available to eligible businesses severely impacted by the Coronavirus (COVID-19) emergency: the enhanced Economic Impact Disaster Loan (EIDL) program and the new Paycheck Protection Program (PPP). In earlier alerts, we summarized the key features of the EIDL program and the PPP program and provided a comparison of the two programs. Given their very favorable terms, these programs will be attractive to many startups and portfolio companies of venture and private equity funds. However, the Small Business Administration’s (SBA) broad affiliation rules could make many of those companies ineligible to participate unless the affiliation rules are relaxed.

On April 2, the SBA released an Interim Final Rule stating that it intends to “promptly” issue additional guidance with respect to the applicability of the affiliation rules to PPP loans. House Minority Leader Kevin McCarthy stated in an interview with Axios that new guidance will stipulate that small businesses that are not controlled by a single outside shareholder will be eligible for PPP loans. It does not appear that the affiliation rules will be relaxed for the EIDL program, and the language of the anticipated guidance will be critical to understanding the relief that will be available to startups and portfolio companies under the PPP program.

In addition to small business concerns and certain other specified companies, sole proprietorships and independent contractors, the CARES Act expands PPP and EIDL eligibility to businesses that employ no more than 500 employees.[1] Generally, the SBA determines whether a concern is “small” by assessing either the average number of employees or the gross receipts of the company, which is determined by the NAICS code that most accurately describes a company’s business. [2] If the average annual receipts over a 3 year period or the average number of employees for each pay period over the past fiscal year of the company, together with its affiliates, is less than the applicable NAICS code size standard, then the company may qualify as a “small business concern.”[3] Whether a business satisfies the 500 employee threshold for the PPP and EIDL programs is subject to the same formula above. [4] For many businesses, especially those that have received outside investments, a key measure for eligibility is the phrase “together with affiliates,” as the size of a concern must be determined by aggregating it with its affiliates.

Under the affiliation rules for SBA loans found at 13 CFR § 121.301, concerns and entities are “affiliates” when one “controls” the other or they both are under common control by a third party. It does not matter whether such control is exercised, so long as the power to control exists, which is determined in reference to the applicable governing documents, such as bylaws, certificate of incorporation, operating agreement, or shareholders’ agreement. Control can be affirmative or negative. Affirmative control is easy. For instance, if the governing documents provide that the founder can make any and all business decisions on behalf of the company, then the founder has affirmative control. Negative control, however, is more complicated.

Negative control exists when a person has the power to veto or block certain ordinary business decisions. This is particularly important for concerns that have received outside investment, as investors ordinarily negotiate certain veto rights to protect their investment. For instance, negative control may be found if an investor (either directly or through any of its representatives on the Board of Directors) has the right to prevent the company from obtaining debt, declaring a dividend or distribution, hiring, firing, or making decisions on employee compensation, or can prevent a quorum.[5] To further complicate matters, certain “extraordinary” actions can be subject to veto or blocking rights without establishing negative control, such as issuing new stock, admitting new members, approving a merger or sale of substantially all of a company’s assets, amending the governing documents or dissolving the company.[6] Although the SBA affiliation rules at § 121.301(f) do not provide specific examples, guidance can be found in SBA Office of Hearings and Appeals decisions interpreting the affiliation rules found at § 121.103.

Along with unexercised negative control, another concept that may be a trap for the unwary is the SBA’s “present effect rule.” Specifically, the SBA will evaluate the ownership and control of a concern by giving “present effect” to agreements or rights that have not yet been exercised, vested, or consummated, such as stock options, convertible securities (e.g., convertible notes), or agreements to merge (including agreements in principle). As such, stock options held by investors, employees, and others will be deemed to have been vested and exercised, and convertible securities will be deemed to have been converted, for the purpose of evaluating affiliation.

For concerns with outside investors, the practical effect is that entities and persons that would not otherwise be deemed equity owners will be deemed to hold such rights, and a concern’s potential affiliates likely will be expanded. For example, if a venture capital fund (VC) has acquired convertible preferred shares of XCorp that, if converted to common stock, would equal 51% of the voting rights of the company, then the conversion will be given present effect, and VC and XCorp will be deemed affiliated.

Thus, with certain limited exceptions,[7] and subject to any new guidance that is released, startups and portfolio companies that are exploring potential loans under the PPP and EIDL programs must determine the scope and extent of affiliation with other concerns, including by closely examining their capitalization tables and governing documents for control interests or rights held by their investors.

Moreover, concerns with outside investors are often impacted by other portfolio companies of those investors. When an investor is deemed to control two or more concerns, then the investor and those concerns all may be deemed affiliates of each other. This results in the aggregation of the average annual receipts and employee count of all of the affiliated entities. It is the aggregation between portfolio companies that often results in a concern failing the size or employee count tests and thereby being ineligible for a PPP or EIDL loan.

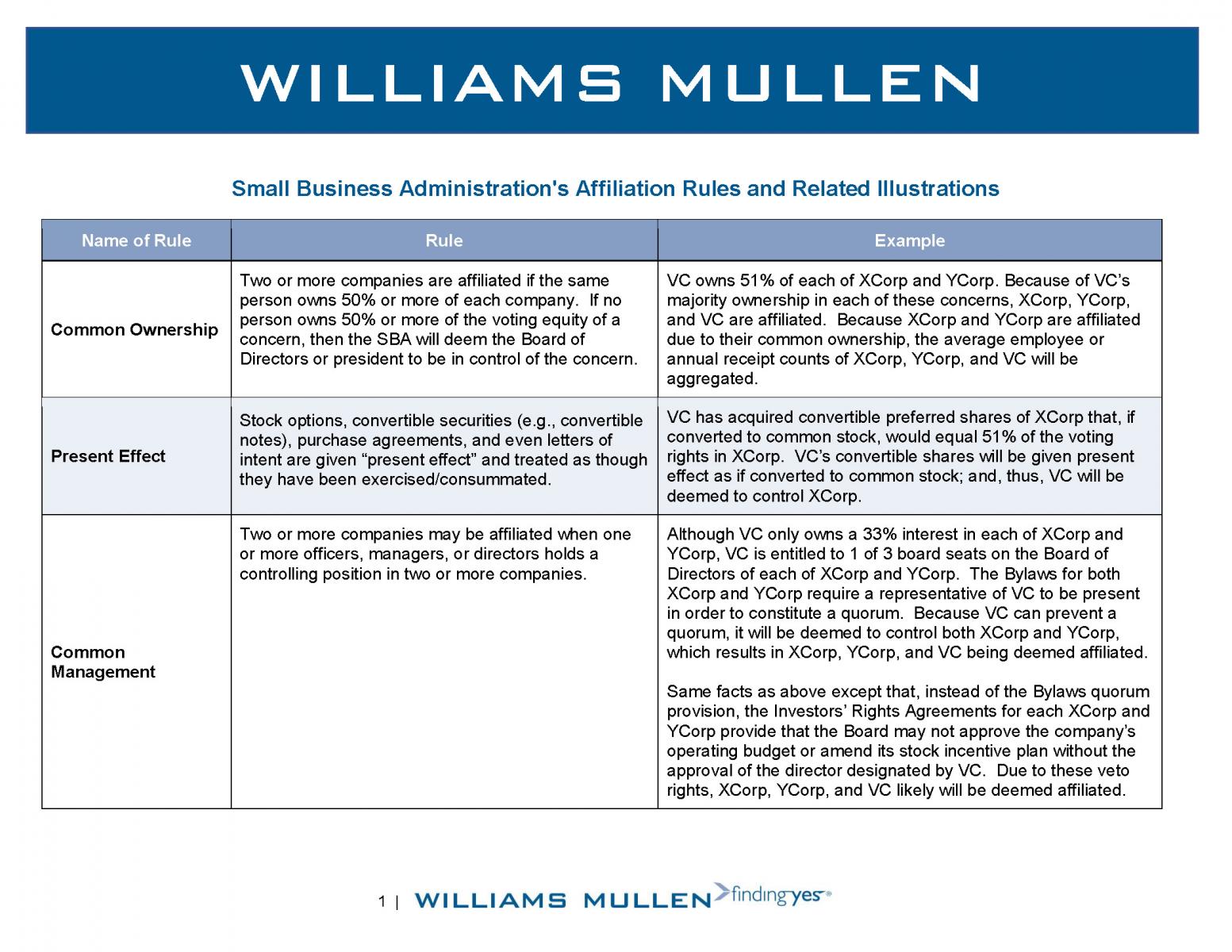

Below is a summary of some of the key affiliation rules and related illustrations as well as a comprehensive chart including other important affiliation rules. For the purposes of these illustrations, assume that the size standard for qualifying for a PPP or EIDL loan is 500 employees and that XCorp has 260 employees and YCorp has 250 employees on average over the relevant periods.

Common Ownership.

Investors tend to invest and have an ownership and/or control interest in numerous entities. Under the affiliation rules, two or more companies are affiliated if the same person owns 50% or more of each company. If no person owns 50% or more of the voting equity of a concern, then the SBA will deem the Board of Directors or president to be in control of the concern.

Illustration: VC owns 51% of each of XCorp and YCorp. Because of VC’s majority ownership in each of these concerns, XCorp, YCorp, and VC are affiliated. Because XCorp and YCorp are affiliated due to their common ownership, the average employee counts of XCorp, YCorp, and VC will be aggregated, and they will exceed the size standard.

Common Management.

Two or more companies may be affiliated when one or more officers, managers, or directors holds a controlling position in two or more companies.

Illustration: Although VC only owns a 33% interest in each of XCorp and YCorp, VC is entitled to 1 of 3 board seats on the Board of Directors of each of XCorp and YCorp. The Bylaws for both XCorp and YCorp require a representative of VC to be present in order to constitute a quorum. Because VC can prevent a quorum, it will be deemed to control both XCorp and YCorp, which results in XCorp, YCorp, and VC being deemed affiliated.

Illustration: Same facts as above except that, instead of the Bylaws quorum provision, the Investors’ Rights Agreements for each of XCorp and YCorp provide that the company may not approve the company’s operating budget or amend its stock incentive plan without the approval of the director designated by VC. Due to these veto rights, XCorp, YCorp, and VC likely will be deemed affiliated.

Identity of Interests and Totality of Circumstances.

Affiliation may arise among two or more concerns when those concerns share an identity of interests, including economic interests or close family or contractual relationships. If the SBA determines that such interests should be aggregated, a concern may rebut that determination with evidence showing that the interests are separate and distinct. For instance, the SBA may find affiliation upon a showing of substantial investments in multiple concerns in related industries, and where such concerns conduct business with each other and also share resources, equipment, employees, or office space.

Illustration: Entrepreneur 1 and Entrepreneur 2 have founded companies together in the past and act as seed investors in startups in a local private incubator. Entrepreneur 1 and Entrepreneur 2 only invest in startups in the mobile application development industry so that they can lease space in a building that they own to the companies in which they invest. The Entrepreneurs also supply the companies with access to equipment and certain administrative resources. The SBA may deem the Entrepreneurs (and each of their respective ventures) to be affiliated.

When the facts and circumstances suggest that concerns are very closely intertwined, they may be deemed affiliated, even if they do not fall within a particular affiliation rule, if the SBA finds affiliation based upon a “totality of the circumstances.” The illustration above presents an interesting example of a factual situation that may lead the SBA to find an affiliation based upon the totality of circumstances even if not due to an identity of interests.

As noted above, it is expected that the SBA will issue further guidance in the coming days that will relax the affiliation rules for the PPP program. Although the extent of the anticipated changes is unknown at this time, it appears that some analysis of control may still be required under the PPP program and that the affiliation rules will not be modified for the EIDL program. Accordingly, pending the release of further guidance, businesses desiring to participate in the PPP and EIDL programs would be wise to review their governing documents and capitalization tables now for potential affiliation issues and consider potential amendments, if necessary and feasible, to eliminate problematic control provisions. We will continue to monitor future guidance and regulations on the PPP and EIDL programs and will communicate our analysis in a timely manner.

Please note: This alert contains general, condensed summaries of actual legal matters, statutes and opinions for information purposes. It is not meant to be and should not be construed as legal advice. Readers with particular needs on specific issues should retain the services of competent counsel.

Please click here for additional legal updates from Williams Mullen regarding COVID-19.

[1] Or such greater number, if any, as the SBA has established for the business’s North American Industry Classification System (NAICS) code.

[2] Such requirement to aggregate gross receipts or numbers of employees of “affiliates” pursuant to the SBA’s affiliation rules is waived for the Paycheck Protection Program under the CARES Act for (i) restaurant and hospitality businesses with not more than 500 employees per location, (ii) SBA recognized franchises, and (iii) SBIC-backed businesses. See SEC. 1102(D)(iv) of the CARES Act.

[3] For instance, the NAICS code for “Data Processing, Hosting, and Related Services” is NAICS code 518210 and has a size standard of $35 million.

[4] The SBA also recognizes an alternate size standard test, which requires:

(i) the maximum tangible net worth of the applicant is not more than $15,000,000; and

(ii) the average net income after Federal income taxes (excluding any carry-over losses) of the applicant for the 2 full fiscal years before the date of the application is not more than $5,000,000.

See 15 U.S.C. 632(a)(5)

[5] See Size Appeal of Eagle Pharmaceuticals, Inc., SBA No. SIZ-5023 (2009) (the payment of dividends or distributions); Size Appeal of Dependable Courier Services, Inc., SBA No. SIZ-2110 (1985) (taking on debt obligations); Team Waste Gulf Coast, LLC v. United States, 135 Fed. Cl. 683, 686 (2018) (hiring and firing executives); Size Appeal of DHS Systems, LLC, SBA No. SIZ-5211 (2011) (executive compensation); Size Appeal of Jensco Marine, Inc., SBA No. SIZ-4330 (1998) (quorum for a shareholders’ meeting).

[6] See Size Appeal of EA Eng'g, Sci., & Tech., Inc., SBA No. SIZ-4973 (2008) (issuing new shares); Size Appeal of DHS Systems, LLC, SBA No. SIZ-5211 (2011) (admitting new members); Size Appeal of Southern Contracting Solutions III, LLC, SBA No. SIZ-5956 (2018) (a sale of substantially all assets and amending the governing documents); Size Appeal of Carntribe-Clement 8ajv # 1, LLC, Appellant, SBA No. SIZ-5357 (2012).

[7] See footnote 2.